January 8, 2025

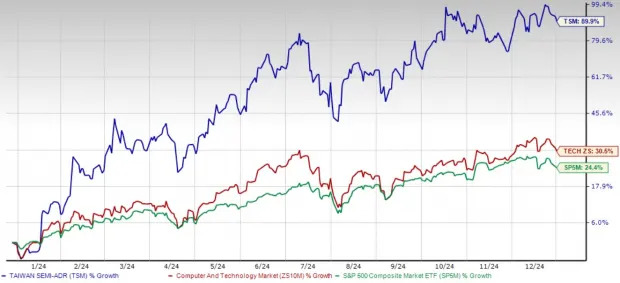

Taiwan Semiconductor Manufacturing Company Ltd. TSM, the global leader in semiconductor foundry services and also known as TSMC, closed 2024 on a high note, delivering a robust 89.9% gain in a turbulent market. This surge has outpaced the broader market, with the S&P 500 and the Zacks Computer & Technology sector rising 30.5% and 24.4%, respectively.

This robust performance cements TSMC’s position as a global leader in semiconductor manufacturing, driven by its critical role in powering artificial intelligence (AI) and high-performance computing (HPC) applications.

Taiwan Semiconductor stock has already risen 7% in the early days of 2025, sparking investor interest in whether this momentum can be sustained. Considering its long-term growth potential alongside emerging challenges, holding the stock appears to be the most prudent course of action for now.

Taiwan Semiconductor’s dominance in advanced chip-making technologies, such as 3nm and 5nm processes, underscores its leadership in the semiconductor industry. These nodes are essential for next-generation AI applications, smartphones and data centers, providing unmatched performance and efficiency.

Taiwan Semiconductor’s robust client portfolio, including NVIDIA Corporation NVDA, Broadcom Inc. AVGO and Intel Corporation INTC, ensures a steady revenue stream. TSMC’s leadership in supplying high-performance AI chips has made it indispensable to the tech giants driving global innovation. This investor confidence is reflected in the stock’s significant rally.

Taiwan Semiconductor’s aggressive $30 billion capital expenditure in 2024 highlights its commitment to maintaining technological superiority. Its ongoing development of 2nm process technology, promising up to 30% power savings over 3nm chips, is a testament to its focus on efficiency and innovation.

Taiwan Semiconductor is also diversifying into high-growth sectors like automotive and the Internet of Things (IoT). Automotive chips, driven by trends like electric vehicles (EVs) and autonomous driving, now account for 5% of its revenues, while smartphone chips remain a significant 34%. These initiatives position TSMC to capture emerging opportunities across industries.

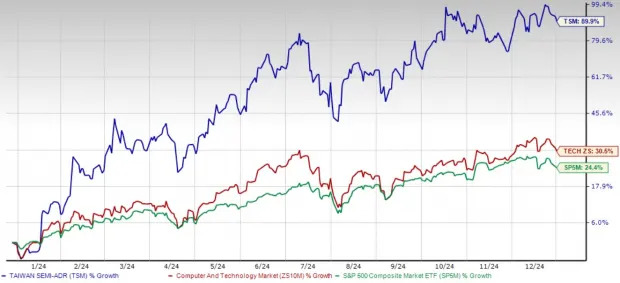

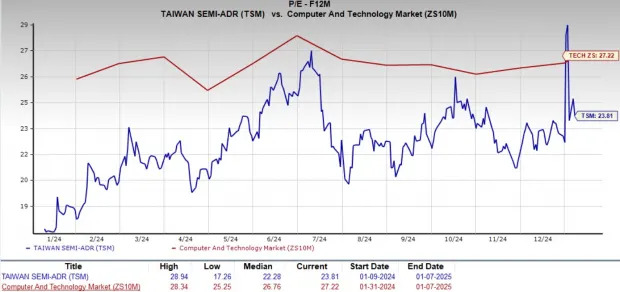

Analysts remain optimistic, projecting strong double-digit revenue and earnings growth for 2025.

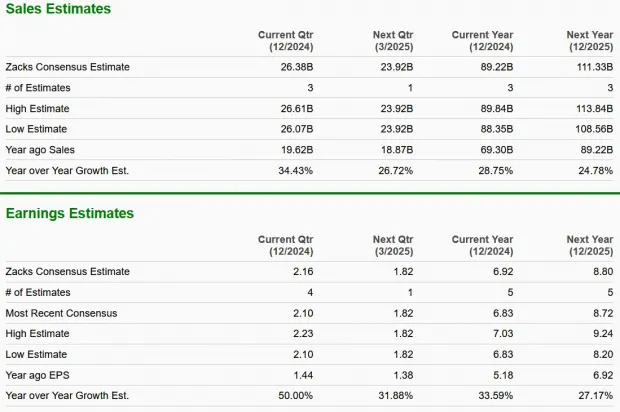

Despite its remarkable rally, Taiwan Semiconductor is not overvalued. The stock trades at a forward price-to-earnings (P/E) ratio of 23.81, below the sector average of 27.22. This reasonable valuation, coupled with the company’s growth potential, offers an appealing entry point for investors seeking exposure to the semiconductor sector.

Despite its strengths, Taiwan Semiconductor faces near-term headwinds. Rising operational costs, especially from its overseas expansion into Arizona, Japan and Germany, are a major concern. These new facilities, while strategically important for diversification, are expected to dilute gross margins by 2-3% annually over the next three to five years due to higher labor and utility costs, coupled with lower initial utilization rates.

Higher energy prices in Taiwan, following a 25% electricity hike in 2024, pose additional challenges, especially as advanced nodes demand greater power. Softness in key markets like PCs and smartphones also dampens near-term prospects. These traditionally strong revenue drivers are projected to see only low single-digit growth in 2025, limiting Taiwan Semiconductor’s growth despite rising AI demand.

Geopolitical tensions, particularly between the United States and China, further cloud the outlook. With significant revenue exposure to China, export restrictions and supply-chain disruptions could pressure Taiwan Semiconductor’s operations.

Taiwan Semiconductor’s technological leadership and strategic investments make it a compelling long-term player in the semiconductor space. However, short-term challenges, including rising costs, weak end-market recovery and geopolitical risks, warrant caution. For now, holding TSMC stock remains the most prudent strategy, allowing investors to benefit from its industry leadership while navigating near-term uncertainties.

Currently, TSM carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here .

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Intel Corporation (INTC) : Free Stock Analysis Report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

Broadcom Inc. (AVGO) : Free Stock Analysis Report

Taiwan Semiconductor Manufacturing Company Ltd. (TSM) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research