UK Earnings, Employment Analysed

- Unemployment rate ticks higher to 4.4% as 50k jobs were shed in May

- Average earnings inclusive of bonuses rose to 5.9% from 5.7%

- Bank of England due to set policy next week and potentially lay the groundwork for a rate cut in the second half of the year as inflation heads lower overall

UK Job Market Eases Further While Wages Remain Persistently High

The UK job market showed further signs of vulnerability after May witnessed the highest claimant count (application for unemployment benefits) since February 2021. Restrictive monetary policy has helped bring inflation down in a notable fashion but the labour market is feeling the effects.

In the three-month period ending in April, employment contracted by 139k (-100k expected) which follows on from a loss of 178k in the three months prior to that.

Average weekly earnings in April rose to 5.9%, proving a sticky data point for the Bank of England to contemplate ahead of next weeks policy setting meeting. However, the Bank has previously expressed it is no longer looking at earnings data as a major contributing factor to inflation pressures, meaning the overall decline in broader measures of inflation are likely to point the Monetary Policy Committee (MPC) towards an eventual rate cut towards the latter stages of the year.

Customize and filter live economic data via our economic calendar

Learn how to prepare for high impact economic data or events with this easy to implement approach:

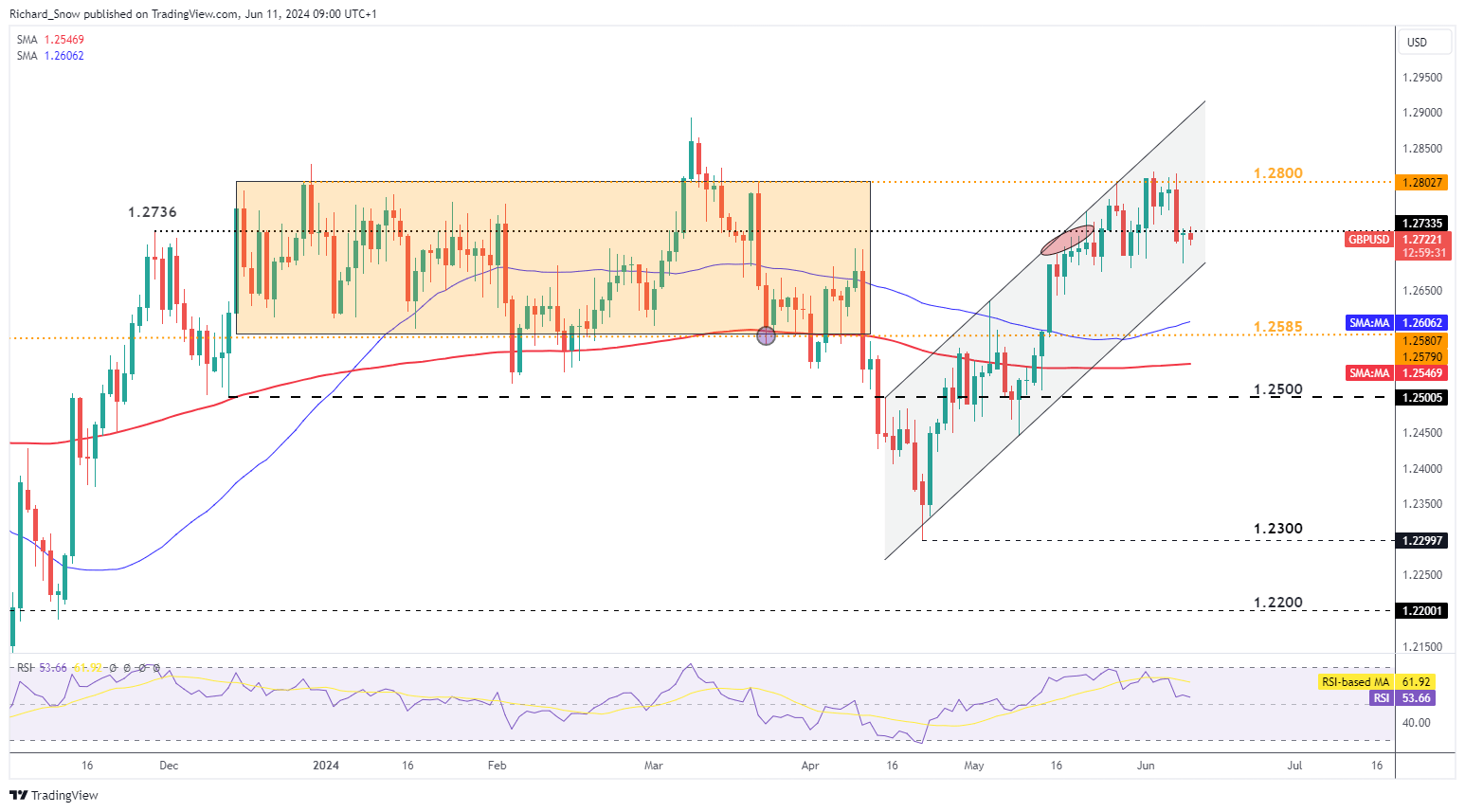

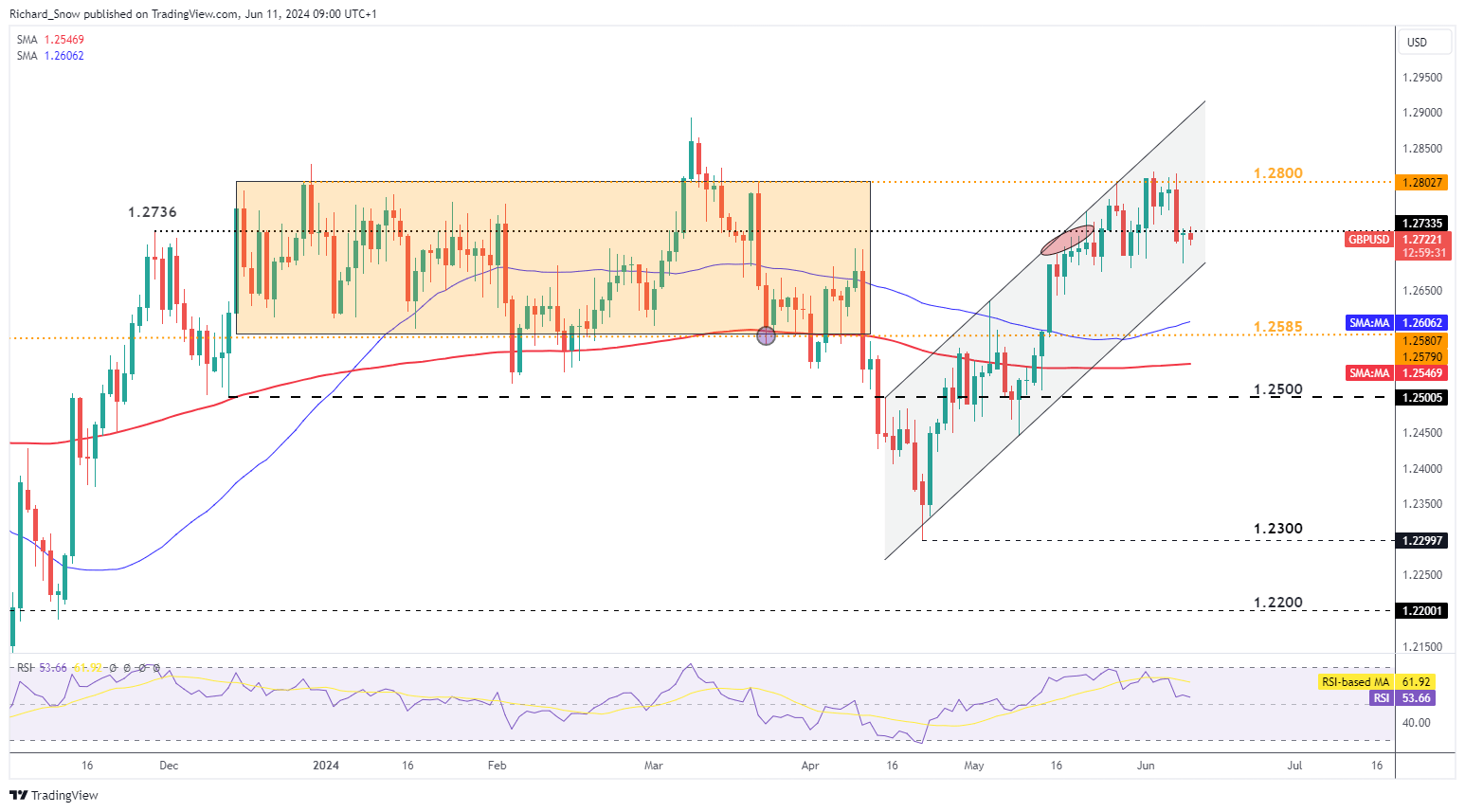

Market pricing reveals an expectation of one, maybe two rate cuts this year – much like the Fed – with November expected to be the month of interest while September remains a possibility if the data becomes increasingly more dovish (lower CPI, higher unemployment rate, low/contracting growth ).

Implied BoE Basis Point Cuts into Year End